There comes a time in every entrepreneur’s life when it becomes necessary to think about funding his business. For some, it’s just a small amount to get started on, while others need millions to develop and further develop their business.

But where do you need to search for funding opportunities and importantly, what does it take to get funded?

We have tried to make an overview and recipe for this in this article.

The stage of the company

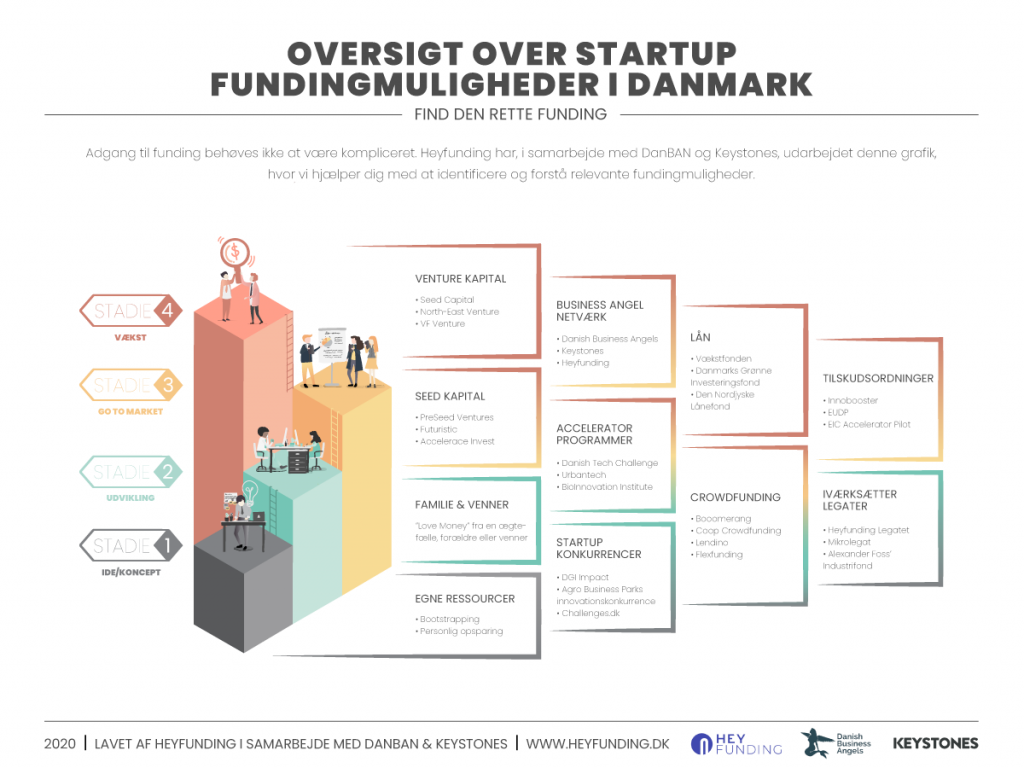

First of all, you need to figure out what stage your business is at. At Heyfunding, we divide startups into 4 different stages, which indicate how far they are.

The 4 stages are:

- Idea

- Development

- Go-to-market

- Growth

OBS: graphics in danish version only

Of course, not all startups are similar, and it can be quite difficult to place oneself/one’s business in one of the predefined stages.

Once you have figured out what stage your business is at, you can start looking at what types of funding are most realistic to seek for a business at your stage.

If you are in one of the early stages, ‘Idea’ and ‘Development’, you can take a closer look at:

- Own resources

- Family & friends

- Startup competitions

- Accelerator programs

- Crowdfunding

- (Startup) Scholarships

If you are in one of the stages in the middle, ‘Go-to-market’ and ‘Growth’, you can take a closer look at:

- Seed and Venture capital

- Accelerator programs

- Business angels

- Crowdfunding

- Grant schemes and programs

- Loan options

Note that it is a good idea to select 1-3 different funding options that you want to focus on. It can be a daunting and half-hearted task if you go to war with all your options at once. Therefore, put your focus in one place at a time, and if it does not pay off, you can always change focus later.

Where to find funding?

When you have figured out what different types of funding you want to apply for, it’s time to get started, but how?

Own resources

Your own resources are about looking at whether you have, for example, savings, profit on the salary account, etc., which you will be able to throw into your company.

The great advantage of using your own resources is that you do not have to give up any ownership shares. One disadvantage, however, is that when the savings/salary account is empty, you have to go out and look for new funding + your possible private “safety net” has disappeared.

Family and friends

If you want help from family or friends, focus on the person(s) who can actually afford to help you. Remember that you are a brand new business and you can’t guarantee that you exist in a year so the worst case is that the person in your network will lose the investment. If you choose to go with this funding option, it is a good idea to have clear guidelines written down in a formal agreement document so that unnecessary complications do not arise or it’s made clear on how to handle them. The agreement document can, for example, contain things like:

- Is it a loan or an investment?

- When and how much is to be repaid? Or what share does each party own?

- Are there any goals/milestones in the agreement?

- How active must the lender/investor be in your company? Etc.

Startup competitions, accelerator programs, and entrepreneurial scholarships

If you want to apply for funding through startup competitions, accelerator programs, or entrepreneurship grants, you have to be aware that many initiatives are aimed at a specific industry – e.g. ‘Agro Business Park Innovation Competition’ focuses on agriculture, food, energy, and the environment, while ‘Guldæg startup competition’ focuses on IT.

Applications for startup competitions, entrepreneurial scholarships, and accelerator programs can be a pitch deck, a specific application, a nomination, etc. Be sure to check up on the requirements of each initiative when applying. Also be aware that not all programs give you a cash prize but other helpful knowledge, access to potential customers, advice, etc. So check what the specific initiative entails and assess whether it is worth the time and energy for you and your business.

Grant schemes and programs

In large, you can approach grant schemes in the same way as competitions, accelerator programs, and scholarships. Here too, Heyfunding can be a good tool for finding the relevant grant schemes.

If you need an in-depth guide on how to get started with applying for funds and grants for your project, you can read here >>

Remember that a grant scheme only comes with a grant for your project – you must therefore co-finance the project yourself. The most popular grant scheme for startups is an Innobooster, and in 90% of all cases, it will be the one that Heyfunding will recommend previous startups to apply for. You can read more about the Innobooster program here.

Crowdfunding

First, you need to decide what type of crowdfunding you want to apply for. Basically, there are 4 different forms of crowdfunding:

- Donation-based crowdfunding

- Reward-based crowdfunding

- Loan-based crowdfunding

- Share-based crowdfunding

Once you know which crowdfunding type makes the most sense for your business, take a closer look at which platform you want to use for your campaign. Then get ready to create your eye- and ear-catching crowdfunding campaign.

Seed capital, venture capital, and business angel

These three categories are often the ones you think of when saying “funding” or “investment”. When you go with seed capital, venture capital, or angel investment you sell a share of ownership interests in your company. Before contacting an investor in this category, you must have prepared the following:

- A pitch deck

- A valuation

- Number of shares you are willing to give up

The number of shares + the valuation tells how much money you can get from an investor. For example, if you estimate that your company is worth DKK 1,000,000 and you are willing to give up 20% of your shares, an investor can buy this for DKK 200,000 from your company. The DKK 200,000 is the investment/funding you receive.

When you search for seed and venture capital funds, you can use Heyfunding’s platform to make a gross list. Then you can contact those who match you and your company best.

Business angels are private individuals and can therefore be difficult to find. There are a number of good business angel networks in Denmark that help startups find an investment – Heyfunding is one of them, and you are welcome to send us your pitch deck right here >>

Good advice for your application

Each fund has its own setup for how an application should be – therefore it’s hard to give a complete guide to how to make an application. However, we have some different exercises and tips on how to make the application process easier.

The 7-word exercise

The first thing people will see in your application is the front page/headline, so you need to get that right. It’s about creating attention and awakening the desire to get to know more about your business.

But can you describe the essence of your business without filling the entire front page/headline with long, complex sentences? If not, try this exercise:

Start by describing your business in 30 words Example: “Heyfunding is an online matchmaking platform for capital-seeking startups and risk-averse investors. We provide an overview of the startup ecosystem, and have mapped over 1,500 initiatives, players, business angels, and investors.”

Now shorten the above description to 15 words Example: “Heyfunding brings together the entire Danish startup ecosystem, from capital-seeking startups to risk-averse investors and players.”

Now shorten your new sentence to 7 words Example: “Your access to the Danish startup ecosystem.”

This little exercise forces you to think about how you describe your company, and at the same time you practice sorting out the unnecessary filler words that fill up your application.

When the exercise is over, you also have 3 different sentences that you can use to describe your business – all depending on how much space you have.

Be aware that the exercise does not necessarily have to be done in one day. It’s perfectly okay to think for a long time about the various descriptions, so you end up with 3 examples that are spot on in describing your business.

The one-pager

On a one-pager, you describe the most important points of your business, relevant to the specific situation. For example, if you are making a one-pager for an investor, it is important to describe your idea, potential, key figures, etc., whereas if you are making a one-pager with a focus on selling your product, it is important to describe the product, USP’s, the price, etc.

A one-pager is super handy to have in many cases, both in a printed- and a digital version. Sometimes it can be used directly as a funding application – or as a supplement to an application. It is also really good to have if you spontaneously meet a potential investor who is showing interest in your business.

The pitch deck

When you pitch for funding, it is very different how long you got to present your business. Maybe you are in a competition where each startup has 2 minutes to pitch. It could also be that you are pitching for a seed or venture fund that would like you to spend more time and go into detail. Therefore, you can not make one pitch deck that you can use every time – or can you? When making a funding pitch deck, you should at least make a slide for each of these points:

- Frontpage

- Problem/solution

- Target group and customers

- Business model

- Sales channels

- Market potential

- Competitors

- Strategy

- Finance / budget

- Proposal to investor

- Team

- Back

Make sure to make each slide independent. That way, you can easily move them around, so that the most important ones (for the specific purpose) can come at the beginning, and the rest is just ready as appendices/answers to in-depth questions.

Example – 2-minute pitch deck:

- Frontpage

- Problem/Solution

- Business model

- Team

- Back

Appendices to in-depth questions:

- Target group and customers

- Sales channels

- Market potential

- Competitors

- Strategy

- Finance / budget

- Proposal to investor

Example – seed or venture fund pitch deck:

- Frontpage

- Problem/Solution

- Target group and customers

- Business model

- Strategy

- Finance / budget

- Presentation to investor

- Team

- Back

Appendices to in-depth questions:

- Sales channels

- Market potential

- Competitors